BREAKING: Aston Martin in crisis, Stroll moves: between Holding and F1 team, here’s what’s going on:… Read more

Aston Martin Faces Crisis: Lawrence Stroll Increases Stake Amid Financial Restructuring

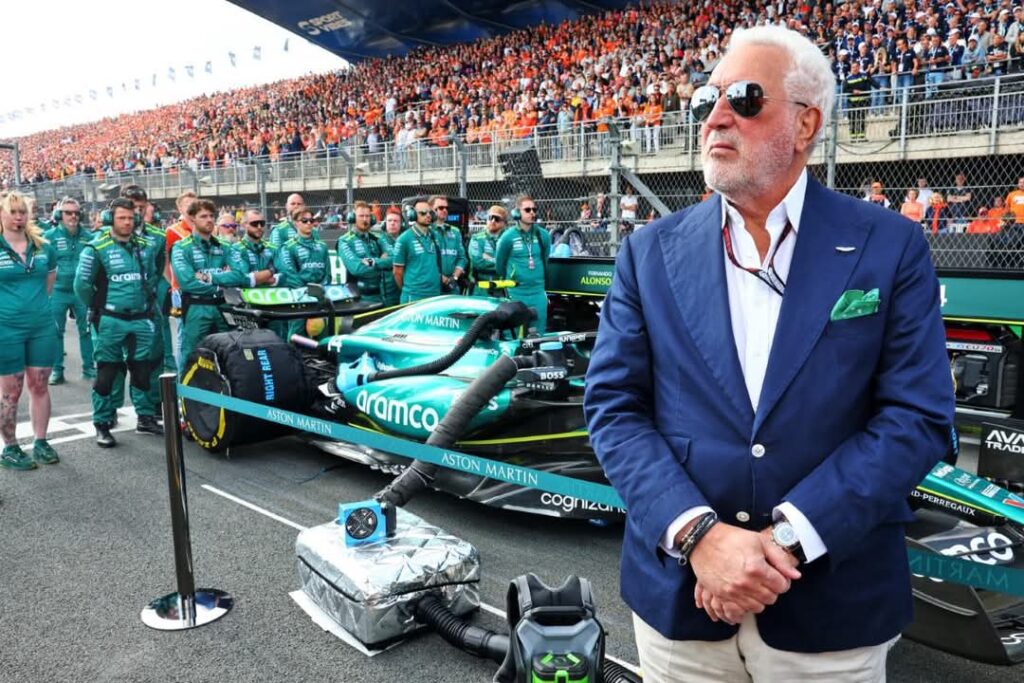

Aston Martin is facing significant financial challenges, prompting Lawrence Stroll to take action in both the company’s road car business and its Formula 1 team. Stroll, the Canadian billionaire who serves as chairman of both entities, is focusing on stabilizing the company after years of accumulating losses and several rounds of workforce reductions. His efforts involve a fresh wave of financial interventions that are aimed at reversing the company’s fortunes.

Stroll, known for his strategic investments, plans to increase his stake in Aston Martin Lagonda Global Holdings from 27.7% to 33%. This move comes as part of an investment by his Yew Tree Consortium, which will inject £52.5 million into the business by purchasing 75 million new shares. This new capital aims to provide much-needed support for Aston Martin, which has struggled in recent years despite its storied history in the automotive world.

The decision by Stroll to increase his ownership stake also comes with some regulatory challenges. Typically, under UK rules, shareholders who cross the 30% ownership threshold are required to make a takeover offer. However, Stroll plans to request a waiver from this rule, which would allow him to avoid triggering a full takeover of the company while still increasing his control.

The news of Stroll’s investment and his plans to raise his stake has been widely discussed in financial circles. According to Reuters, the waiver would enable him to retain greater flexibility in managing the company’s affairs while avoiding the complexities of a full takeover process. Stroll believes that this investment will have a positive impact on market confidence and reassure shareholders who have seen Aston Martin struggle to maintain its financial stability.

In a statement, Stroll expressed confidence in the move, highlighting the premium value of the investment compared to recent stock prices. “The investment, valued with a 7% premium compared to Friday’s stock close, should greatly reassure shareholders,” he said. His optimism reflects the belief that these measures will help steer the company toward a more secure financial footing.

While Stroll is increasing his investment in the broader Aston Martin enterprise, he is also making strategic decisions regarding the company’s Formula 1 team. The team remains under Stroll’s control through his personal holdings and his offshore company, Yew Tree Overseas, which is based in the British Virgin Islands. Although there has been a sale of the minority stake held by Aston Martin Holdings in the F1 team, the main operational structure of the team remains unchanged.

Aston Martin’s F1 team, which has been a key part of the brand’s global marketing strategy, emphasized that the move would not affect its long-term branding partnership with the car company. This partnership, which runs through 2030, is considered vital for maintaining Aston Martin’s high-performance image on a global stage. Despite the financial restructuring and changes in shareholding, the team is confident that its connection with the road car business will remain strong.

In summary, Lawrence Stroll’s decision to increase his stake in Aston Martin comes at a critical time for the company, as it undergoes another phase of financial restructuring. With a significant injection of new capital and a strategic approach to both the road car business and the F1 team, Stroll is aiming to restore stability to the company and reassure investors that Aston Martin is on the path to recovery. The moves made by Stroll could potentially help Aston Martin regain its footing in a competitive automotive market while also maintaining its presence in Formula 1, which remains a crucial part of the brand’s identity.